Read our latest resources

Artificial Intelligence and Machine learning mortgage to revolutionize the mortgage industry.

We are extremely elated to announce that Digilytics AI recently won ‘Product of the year’ by FT Adviser Diversity in Finance Awards (2nd time in a row)!

The latest technological revolution pivots around artificial intelligence and machine learning technologies, leveraging their “smartness” for various purposes.

As of the end of 2020, 24.7 million people worldwide use open banking. The estimated growth rate is at a whopping 50% between 2020 to 2024.

According to Fannie Mae, 69% of buyers would apply for mortgages online.

The mortgage market in the UK is standing on the edge of a transformation.

The Housing Industry in the UK is slacking at closing mortgages soon.

The mortgage lending market in the UK dates back to the late 18th century.

Technology has played a dominant role in UK’s mortgage origination. It has automated most of the processes and has made the entire system more efficient.

There are several different mortgages that one can apply for in the UK mortgage market. However, when the borrower’s loan applications are rejected, an entirely new area called specialist lending comes into the picture.

Every day, thousands of people apply for mortgages in the United Kingdom. In 2020, the gross mortgage lending was valued at 245.91 billion British pounds.

The COVID-19 pandemic had a significant impact on the UK mortgage lending market.

Artificial intelligence (AI) grows more sophisticated by the day, and it continues to make work easier with its various applications in healthcare, logistics, education, and even finance.

Documents are an integral part of the loan origination process. Borrowers send in their applications and documents that contain information on their personal and financial details.

A lot goes into buying and building your dream home or establishing your business from scratch. Loans and mortgages provide a significant boost to your finances that help you make your house or your business.

The UK mortgage lending industry has come a long way in utilizing digital means to transform traditional and manual lending methods to modern automated ways.

The mortgage industry is a vital part of the United Kingdom’s house transaction system.

The electronic prefix ‘e’ has seamlessly attached itself to the United Kingdom (UK) mortgage origination industry.

The United Kingdom's (UK) mortgage market reached 1.66 trillion euros of outstanding residential mortgage lending in the fourth quarter of 2020, leading all the other European countries.

The novel coronavirus has had a major impact on every industry and sector, including the housing and mortgage market in the United Kingdom (UK).

When one considers the top view of the mortgage industry, it is difficult to comprehend its associated carbon footprint.

All about One-shot Learning AI technology and its impact on the UK Mortgage Market

For a very long time, the mortgage industry in the United Kingdom (UK) has pretty much remained the same.

Problems in the validation of mortgage origination documents

The global economy is expected to shrink by 3% due to COVID-19 pandemic. Unemployment rates are progressing on one hand, and businesses are cutting pay on the other.

These are the typical ads that give loan borrowers the hope of getting loans in short periods, which eventually lead to utter disappointment due to the lengthy lending applications and underwriting process.

Last week Digilytics AI concluded its webinar series on Intelligent Affordability Services. The feedback was overwhelmingly positive.

While using a cloud-based loan origination system, documents are stored remotely, and secured in an encrypted centralized server system.

In May 2020, the Bank of England warned that the UK economy is facing the sharpest downturn since 1706.

Training a machine learning model should not be too different from the human process of learning.

Digilytics AI is one of the top 30 ML-powered start-ups shortlisted in the ML Elevate program by YourStory Media & Amazon Web Services (AWS)

Mortgages are essential to both consumers and financial institutions. Unfortunately, the mortgage lending process is very complex and involves numerous manual interventions.

The future of AI mortgage lending is bright. The rapid advancements in technology especially in the mortgage industry are commendable.

Loan origination is the process by which a borrower applies for a new loan, and a lender processes that application.

As the global economy moves to recover from a devastating pandemic-dominated 2020, we are seeing an increase in government borrowing.

Mortgage industries are witnessing a massive shift in their lending journey, right from the beginning till the end.

Lenders tend to spend long hours filling out an application and gathering documents in their mortgage process.

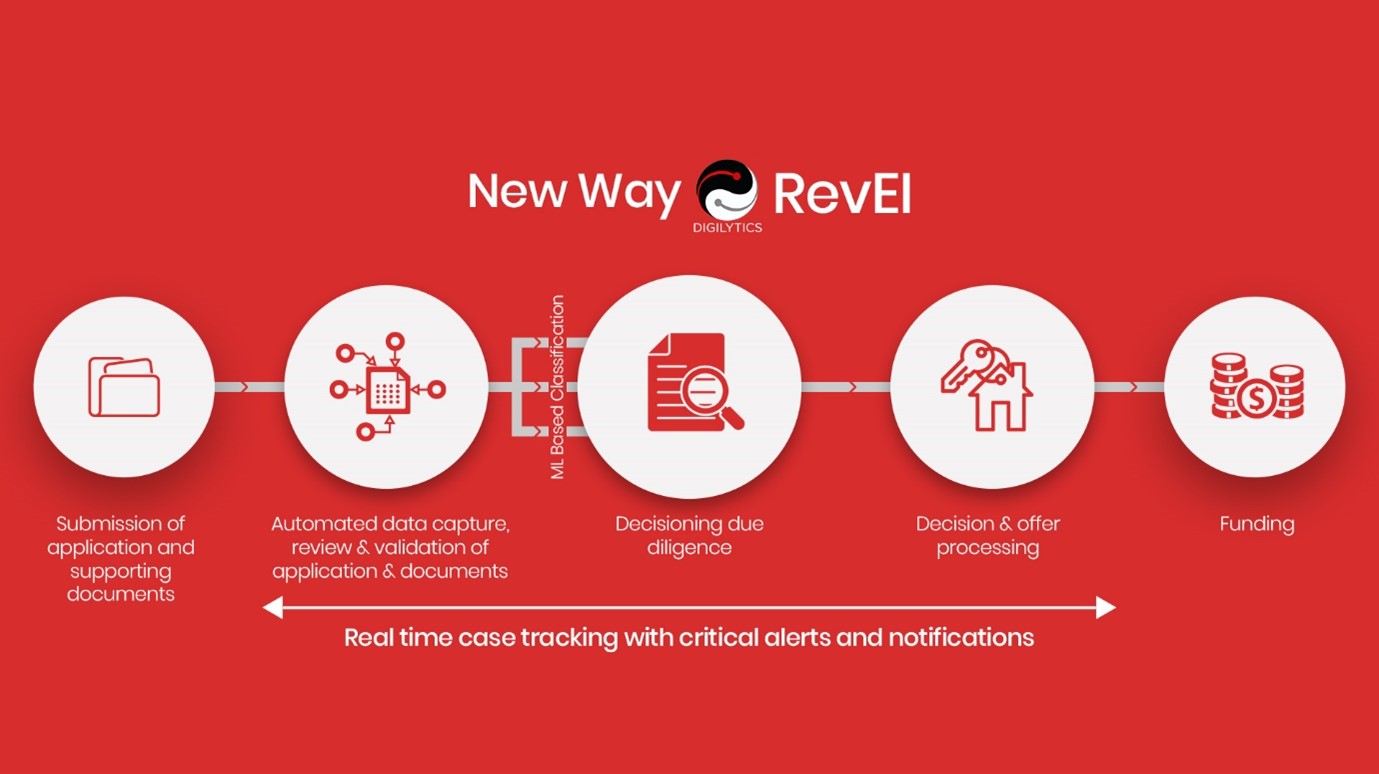

Are you spending days processing an application or requesting documents in your mortgage origination process?

Just like supply chain, manufacturing and other sectors of global industries, industry 4.0 has also reshaped the financial services significantly.

In this MoneyAge feature, catch our Founder & CEO, Arindom Basu, explain the Power of Intelligent Digital in the Mortgage Industry, drawing from his illustrious experience.

In recent years, an unimaginable amount of technology and innovation has expedited the adoption of digital mortgage.

Data, data everywhere but not a defined strategy to predict!

Digilytics AI recently won Diversity in Finance Award for Product of the Year Category 2020. The virtual event was hosted on 2nd September 2020, in association with MetLife UK.

With the world evolving at a rapid speed, mortgage lending has progressed haphazardly. The current origination process across lenders in the mortgage industry is lengthy and frustrating.

In this interview, you’ll get an experts view on what COVID-19 means for mortgage lenders and how businesses offering a mortgage service should look at the current market.

In the ever-changing landscape of the UK Mortgage Market, the Gross lending doubled to more than £268bn in the last decade.Read our blog on AI Journal to know more.

In this blog, you’ll read about the top 3 reasons why the mortgage industry should adopt intelligent digital sooner than later

Watch this short clip to know more

90% of mortgage origination in the UK and Ireland is non-intelligent. Around 40% of origination requires manual intervention, resulting in a higher time to credit.

The longstanding tradition of British home-buying took a massive hit with the emergence of the global pandemic.

In the era of Industry 4.0, the entire existence of this revolution is based on digitization or as we fondly call it, ‘The smart machines.’

Automating paper-less systems with intelligent data capturing technology helps to improve process efficiency and to create business value

Taking businesses to next level of digitisation leveraging AI. In today’s world, even after so much digitisation, many organisations still rely on traditional paper-based processes

Traditionally, capability development focuses on improving planning and control within organisations

Companies fixated on quick wins and easy growth, are increasingly innovating to sell to existing customers. Cross-selling to a customer is however different from up-selling to a customer.

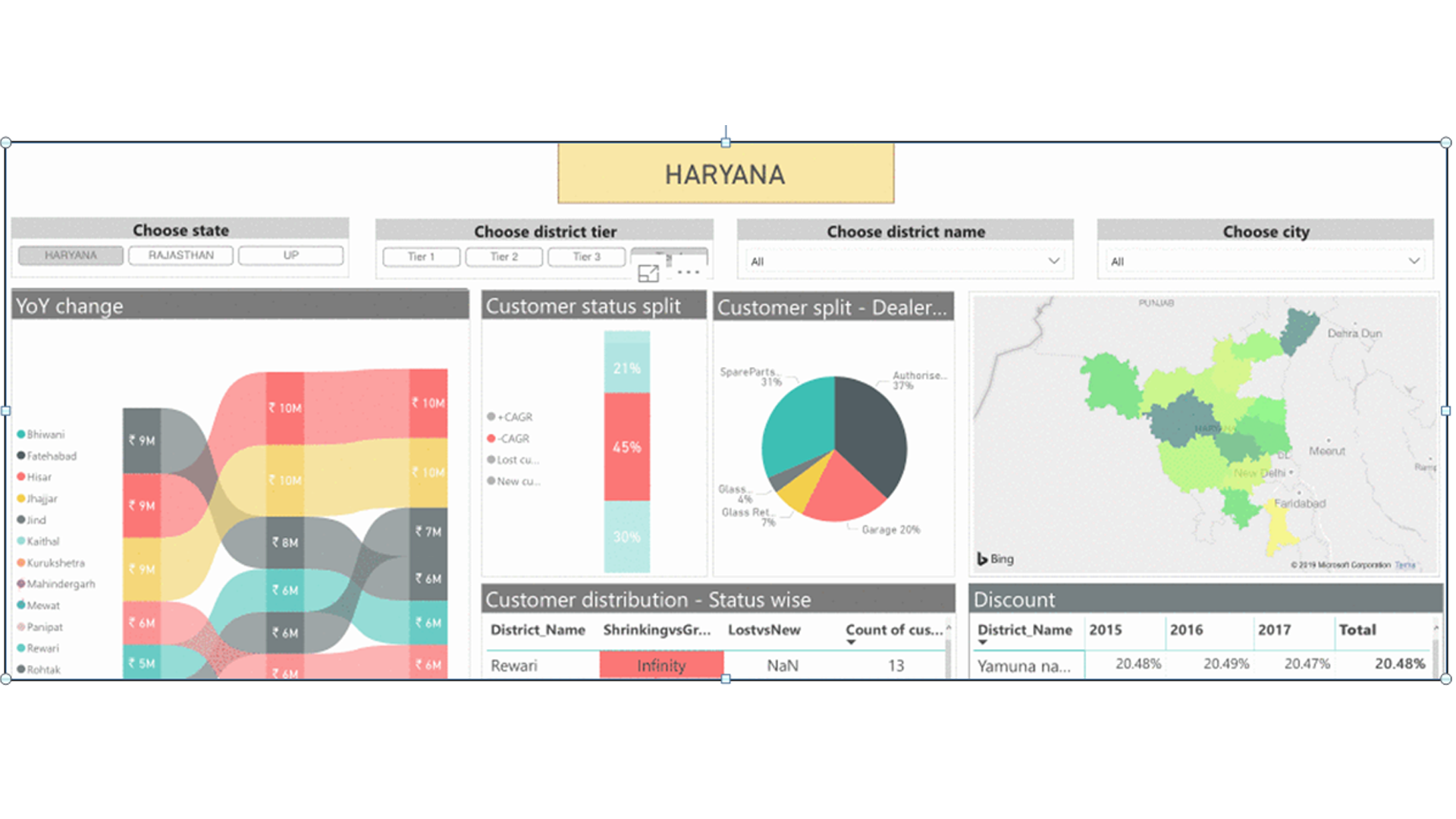

In the current age of terabytes & petabytes, every organization is striving to drive business value with data backed insights. BI has become the go-to strategy for every future-proof business - be it the HR in an industrial goods company, the customer support in a financial institution or the marketing team in a professional services firm.

Fintech firm Digilytics AI has partnered with AccountScore by integrating the open banking service into its new Intelligent Affordability Service.

We're going to be looking at everything to do with FinTech and InsureTech, how these technologies are changing industries, changing buyer behavior,

Average number of application submissions is 4! Applications are Often Incomplete and Inconsistent

Streamlining the lending process through income and expense verification been cited by many, across the mortgage industry.

Join our CEO speak to a panel of mortgage leaders from industry and academia across the UK and the US.

The webinar will discuss innovative recovery strategies that SME lending brokers and lenders are adopting.

The COVID crisis has had a major impact on the balance sheets of governments. How will governments recover from this?

This on-demand webinar discusses the rise of intelligent digital in post covid era.

The Covid crisis has had a major impact on the balance sheets of governments. How will governments recover from this ? Watch the video, to know more.

Hear from the panelists, about their personal experiences of how technology was leveraged during some of the crises, and what technology wave we can expect as a result of COVID crisis.

A seamless cloud-based loan origination system providing real-time insights and recommendations and making business operations transactions intelligent and more effective.

DigiMod enables classification and provides decision support in an explainable manner (Xplainable AI)