Economic cycles are a given, sort of like the sun rising every day. If you are new to the mortgage industry you may have only witnessed growth and prosperity. But ask any seasoned veteran and you can be sure they have lived through ups and downs. Those with over 2 decades of experience have likely gone through it more than once. These cycles can be scary whether you are a role player in a larger company, a sole practitioner, or the owner or leader of a business. So, how do you deal with this phenomenon psychologically, and what can you do to best survive the lean times and thrive in the next upturn?

Since this isn’t an article on emotional well-being, we’ll focus on the tactical and strategic steps to embrace as the lean times approach. You’ve heard the saying, “timing is everything”, well in this situation it may not be everything, but it is vital. In most businesses, staying ahead of the pack is often the key to surviving. And enduring in this case means right sizing the organization in advance of economic and financial conditions requiring drastic cuts. Think of “skate to where the puck is going, not to where it is currently”.

By now you may be pondering, “If I cut back now how can I get the existing work done?” or “I invested in people and training and when things improve, I’ll need to rehire and re-train anyway”. The answer to both these thoughts is simply technology. Technology, when applied and implemented properly gives you a tremendous competitive advantage. It does this by enabling more work to be performed with less personnel so when the cycle trends upward, you are not scrambling to hire and train new staff. It also saves costs in the short term as well as the long term. When margins and profitability are high during boom times, this may not be as important, but in the current shrinking environment, preserving cash and lowering costs can be the key to survival.

Recent advances in mortgage technology have been accelerating. While basic automated underwriting systems and loan origination systems have been around for decades, it’s only been in the last few years when artificial intelligence, deep learning, and expert systems have made deep strides. Not in replacing people, but in allowing more to be done with less.

The first phase of cost cutting used to be finding cheaper labor offshore. However, global wage inflation and tighter regulations and compliance have offset the value this approach once offered. Routine tasks such as indexing documents and staring and comparing data amongst documents can now be done with high accuracy and speed solely by computers. Higher level jobs such as calculating income, assessing collateral, or interpreting credit, can be performed by technical platforms and applications with a high degree of precision.

By applying technology to get things right the first time and eliminate the back and forth between various parties in the transaction, not only is time saved, but real money is saved, and a better borrower experience is realized. While it can be challenging to spend and make changes during slow periods, we all know it is even harder to do so when things are crazy busy, and attention is completely given to production and keeping things on track.

Now is the time to make investments in technology, to change your workflow, to right-size your organization, and prepare for the inevitability of more favorable industry dynamics and prosperous times.

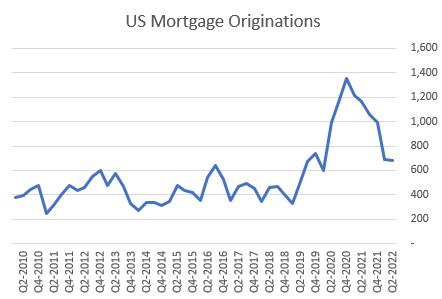

Source: Mortgage Bankers Association

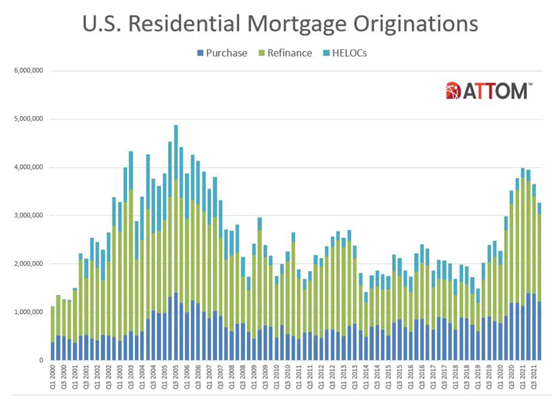

Source: Attom

Follow us on Twitter | LinkedIn

Author: Larry Fried, Country Head, USA at Digilytics AI

Posted Under: US Mortgage Originations