Five Ways to Make Your Mortgage Affordability Assessments More Inclusive

Why Inclusivity in Affordability Matters

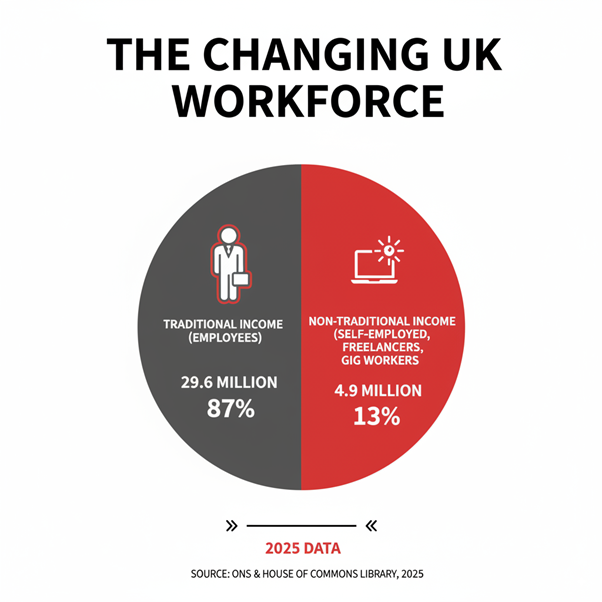

The UK workforce is changing. According to the Office for National Statistics, around 29.6 million people (87%) are employees in traditional salaried roles. But a significant 4.9 million workers, nearly 13% of the workforce, earn through non-traditional income sources such as self-employment, freelance contracts, or gig platforms. (House of Commons Library, 2025).

This shift poses a clear challenge for lenders. Affordability checks are still largely designed for payslips and steady salaries, leaving millions of borrowers disadvantaged even when their earnings are sufficient.

At the same time, the FCA’s Consumer Duty, which came into effect in 2023, requires lenders to “act to deliver good outcomes for retail customers”. This includes avoiding foreseeable harm and ensuring assessments are fair, transparent, and inclusive.

The question for lenders is no longer whether to adapt, but how to redesign affordability models to reflect today’s workforce.

How lenders can meet Consumer Duty requirements while serving non-traditional earners.

1. Open Finance Integration Open Finance extends beyond bank account data to include broader financial information such as investments, pensions, and insurance. For lenders, this provides a holistic view of a borrower’s financial position, reducing the risk of overlooking creditworthy applicants whose income is diversified.

2. Open Banking Adoption Open Banking gives lenders secure access to real-time bank transaction data. This makes it easier to validate income streams directly from the source, improving accuracy and reducing the reliance on paper documents that may be incomplete or inconsistent.

3. Automated Income Categorisation Non-traditional earners often have income scattered across invoices, platform payouts, or rental agreements. Automated categorisation enables lenders to standardise and reconcile multiple income sources quickly, reducing manual intervention and error risk.

4. AI-Driven Assessments AI models can recognise patterns across diverse income profiles, accounting for seasonality or irregularity. This allows lenders to assess sustainability more fairly, reducing bias in decision-making and improving consistency in underwriting.

5. Faster Decisioning By reducing manual effort, lenders can accelerate underwriting while maintaining compliance. Faster decision-making improves the borrower experience and reduces operational costs, while ensuring that non-traditional earners are not disadvantaged by longer processing times.

Closing the Affordability Gaps

Together, these five practices make mortgage affordability assessments more inclusive, without compromising efficiency or compliance. They close the gaps created by outdated models, reduce operational strain, and ensure that lenders are prepared to serve a workforce where nearly 1 in 7 people earn outside the payslip model.

Is Your Affordability Model Fit for the Future?

At Digilytics AI, we believe that inclusive affordability is the foundation of sustainable mortgage lending. The lenders we work with are already exploring ways to balance compliance with innovation.

👉 Get in touch with a Digilytics Consultant to find out if your Affordability Assessment Model is ready to meet the needs of today’s workforce.

Author: Shradul Kumar Arora and Jahnavi Chhabra, Business Analyst at Digilytics AI

While you are here, other top articles you might be interested in

Role of AI in SME loan origination Verifying Information in Mortgage Lending Process: Supporting Documents vs. Data Sources? All about One-shot Learning AI technology and its impact on the UK Mortgage Market A change in technology is coming to the UK Mortgage 3C checks: The Digilytics Art of validating mortgage documents The Future of Computer Vision, Machine Learning and Artificial Intelligence in Mortgage Industry How industry 4.0 principles can work in the favor of mortgage origination? Top 5 Real Challenges in Building Predictive Models in Mortgages 5 Ways in which Mortgage Lenders can Leverage Digital Lending for Good- + Accelerating Time to Offer in Mortgage Industry

- + Intelligent Affordability Service

- + Applying industry 4.0 principles to mortgage origination

- + Leveraging AI to move to the next level of digitization in mortgages

- + Intelligent Data Capture

- + Sell Different Sell More

- + Making Insights Actionable

- + Harnessing your data assets