Revel levels the playing field, allowing lenders of any size to implement a modern AI & Machine Learning infrastructure.

If you don’t have time to do it right, when will you have time to do it over?

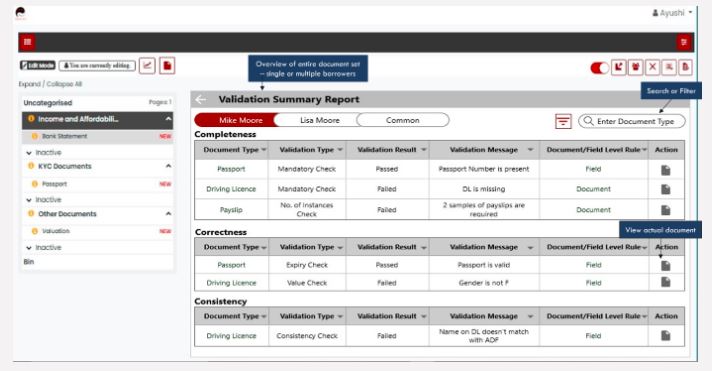

With Revel’s First Time RightTM Document Indexing, Data Extraction & Data Validation capabilities, Loan Officers, Processors, & Underwriters are set up for success. When your team starts the initial approval & underwriting process with high-quality, validated data, they avoid errors, eliminate rework, and shave days from the process.

Keen as mustard to get started? We’d love to hear from you.

Better algorithms yield superior results

We use proprietary AI lending platform & Deep Learning technology which allows us to retain a level of flexibility, consistency, and reliability that Robotic Process Automation cannot.

- One Shot LearningTM self-trains on new documents quickly

- Hundreds of mortgage-specific documents (Bank Statements, Paystubs, W2, Tax Documents )

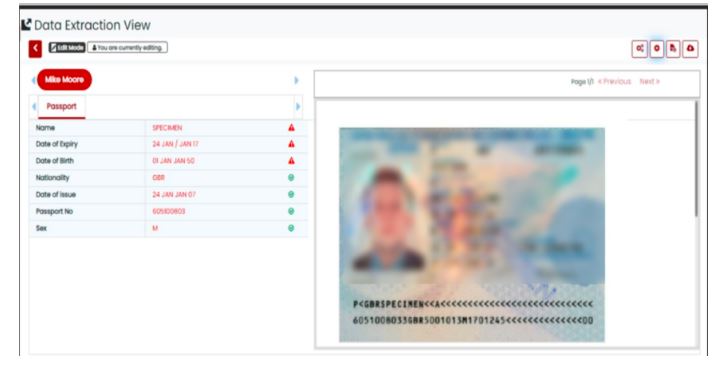

- Reads images (Passport, Driver’s License)

- Human in the Loop service option available

Out-of-the-box configuration gives development a head start.

- Stand-alone user interface or access via API integration

- White label to your brand

- User authenticated views

- Multiple borrower documents displayed in a single view

- Intuitive workflow and user interface

- Flags items that require review

- Real-time SLA reporting

Only Revel Offers

Customization

Elevate your business potential with our Consulting & Advisory solutions designed to address your needs.

Control

Drive your organization towards its goals with our Strategic Planning expertise and actionable strategies.

Clarity

Through training programs and expert guidance, we empower learners to develop proficiency in their areas.